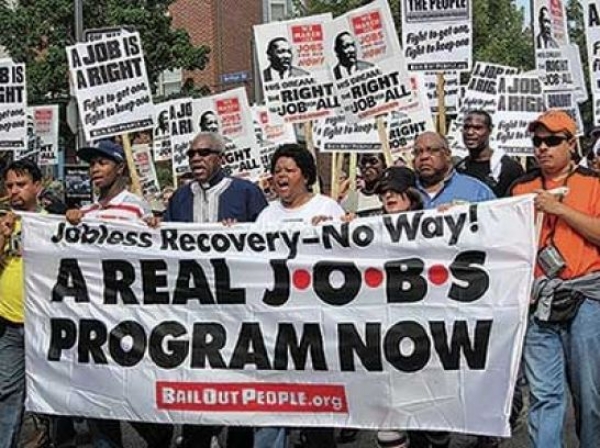

The Act aims to provide a job to any American that seeks work and to, ultimately, create a full employment society.

• The Act establishes a “Full Employment and Training Trust Fund” with two separate accounts. These two accounts will direct funding to job creation and training programs.

Dual Job Creation Focus: Direct Jobs Grants and WIA Training Programs

• The first trust fund account will direct funds to a new innovative direct jobs program. Funds will be distributed by formula through the Department of Labor to larger cities and states, and then be passed to localities and rural areas.

o The program will allocate funds based on the Community Development Block Grant formula modified to consider unemployment data. Local elected officials, who are closest to our communities and needs on the ground, would work with community groups and labor leaders to identify critical projects and connect workers to projects right away.

o Jobs could be in the public sector, community-based not-for-profit organizations, and small businesses that provide community benefits.

o The Program will adopt a two stage approach to ensure immediate job creation, and allow for a longer term planning process that involves community input and a focus on education and career development.

o Positions will be for up to 45 hours per week, for at least 12 months. They will pay comparable or prevailing wages, as well as benefits. Appropriate safeguards and strong anti-displacement protections will help to prevent substitution and ensure that workers are placed in new positions.

• The second trust fund will distribute funds to job training programs covered under the Workforce Investment Act.

o These funds will fund innovative job training initiatives including One Stop Job Training Programs and the Job Corps.

Revenue: Taxing Wall Street Transactions to Pay for Main Street Jobs

• Revenue for the trust fund will come from a small levy on covered trading transactions

o 0.25% on stocks = 25¢ on every $100 traded in stocks

o 0.02% on futures, swaps, and credit default swaps = 2¢ on every $100 traded on these types of transactions

o The rate for options contracts would be imposed on the underlying transaction multiplied by the premium paid for the option (still very small)

• There are exemptions for retirement accounts.

Imagine going to the polls on Election Day and discovering that your ballot could be collected and reviewed by the

Imagine going to the polls on Election Day and discovering that your ballot could be collected and reviewed by the ACLU Blueprints Offer Vision to Cut US Incarceration Rate in Half by Prioritizing 'People Over Prisons'

ACLU Blueprints Offer Vision to Cut US Incarceration Rate in Half by Prioritizing 'People Over Prisons'  "These disasters drag into the light exactly who is already being thrown away," notes Naomi Klein

"These disasters drag into the light exactly who is already being thrown away," notes Naomi Klein  How about some good news? Kansas Democratic Representative advances bill for Native Peoples.

How about some good news? Kansas Democratic Representative advances bill for Native Peoples.  What mattered was that he showed up — that he put himself in front of the people whose opinions on

What mattered was that he showed up — that he put himself in front of the people whose opinions on On a night of Democratic victories, one of the most significant wins came in Virginia, where the party held onto

On a night of Democratic victories, one of the most significant wins came in Virginia, where the party held onto A seismic political battle that could send shockwaves all the way to the White House was launched last week in

A seismic political battle that could send shockwaves all the way to the White House was launched last week in In an interview with Reuters conducted a month after he took office, Donald Trump asserted that the U.S. had “fallen

In an interview with Reuters conducted a month after he took office, Donald Trump asserted that the U.S. had “fallen Attorney General Jeff Sessions overturned the sweeping criminal charging policy of former attorney general Eric H. Holder Jr. and directed

Attorney General Jeff Sessions overturned the sweeping criminal charging policy of former attorney general Eric H. Holder Jr. and directed