Collapsing crude oil prices due to oversupply are reaching tsunami proportions, threatening Wall Street banks, investors and a dozen countries, foremost Russia, Iran and Venezuela, where revenue losses have caused severe financial degradation, and economies are about to implode. While Americans are today enjoying $2 per gallon gasoline, Wall Street's analysts predict that an imminent energy market collapse will bring financial institutions to their knees once again, and taxpayers are being set up for another mandatory bailout.

At the heart of these tectonic shifts in the entire energy sector is the recent expansion of the hydraulic fracturing (fracking) industry, a boom cycle that began in earnest when Congress and the Bush administration passed the Energy Policy Act of 2005, which exempted the new horizontal drilling technology from the Clean Water Act, the Safe Drinking Water Act and the National Environmental Policy Act. By tapping considerable quantities of new oil and gas resources from shale deposits, the fracking boom promised US energy independence, upending the world's prevailing paradigms around renewable energy and peak oil expectations. Environmentalists fought against the huge Keystone pipeline infrastructure that would deliver the fossil fuels to foreign markets, fearing that exploiting these resources would undermine the struggle for the curbing of carbon emissions.

Fracking also threatened the dominance of Russia and Saudi Arabia as the fossil fuel suppliers of Europe when it became evident that the United States would soon become a net exporter. In the United States, fracking was hyped on Wall Street as a get-rich-quick opportunity, attracting massive capital input, and creating an investment bubble. Bloomberg reported this year that the number of bonds issued by oil and gas companies has grown by a factor of nine since 2004.

"There's a lot of Kool-Aid that's being drunk now by investors," Tim Gramatovich, chief investment officer and founder of Peritus Asset Management LLC, told Bloomberg in an April 2014 article. "People lose their discipline. They stop doing the math. They stop doing the accounting," he continued. "They're just dreaming the dream, and that's what's happening with the shale boom."

When gas fracking first popped onto the scene, grandiose claims were made that the United States had 100 years of gas supply in shale, or 2,560 trillion cubic feet. And Wall Street rode that initial estimate. The only downside (beside the environmental disaster left by this toxic industry) was that, like the housing bubble which depended on ever-growing home values to maintain profitability, shale gas wells had to deliver consistent or growing production and profitability to pay back heavy debt interest loans on well driller companies: $3 to $9 million per well. Fracking wells require not just drilling, but also huge injections of energy, water, sand and chemicals to fracture the rocks that hold the oil and gas deposits.

But in fact, no statistical evidence confirmed the hyped claims of a 100-year shale gas supply. In 2011, a study downsized this estimate from 2,560 trillion cubic feet to 750 trillion cubic feet, and by 2013, the US Geological Survey refined that down to 481 trillion cubic feet - less than a 19-year supply based on 2013 rates of production. Nevertheless, huge amounts of capital poured into increasingly marginal operations, and the fracking market was flooded with junk bonds and derivatives as investors piled in.

Meanwhile oil fracking, which is separate from gas fracking, also needed huge injections of capital, but more importantly, oil frackers needed oil prices to stay at $85 a barrel or higher on average to break even. Many of the shale oil wells that have sucked up a huge amount of investment have also turned out to have short lives and their operators required continued infusions of capital to drill new wells to keep afloat, even as prices tumbled due to the glut they themselves created. The Bakken, one of the largest oil fracking plays, is a typical example. It grew exponentially after environmental protections were removed. But since 2008, Bakken has required increasingly larger numbers of wells just to maintain level production and service debt. The industry, already in trouble in 2013, has now endured plunging revenues through a year of oil selling at $60 to $70 per barrel, on average, instead of $90 to $100.

Bakken Oil play Chart. (Source- Post Carbon Institute: Drilling Deeper Report.)

Everyone had expected that in 2014 the Saudis would move to limit supply and maintain stable oil prices by cutting back production, as OPEC has done for decades. But an unexpected shockwave hit the industry in November 2014: The Saudis laid down the gauntlet and announced their intention to continue full production and let oil prices drop.

For the Saudis, this serves two purposes: First, it undermines the expansion of US shale oil by forcing prices down so low that many of the wells have to be shut down or lose money. Second, it punishes their enemy, Iran, whose oil export-based economy has been savaged by the lower prices. The Saudis are sitting pat, with a trillion-dollar war chest savings account accumulated over a decade of $100 per barrel oil. Oil Minister Ali al-Naimi has publicly admitted that the Saudis will wait as long as needed to retain market share, even if prices plunge further.

Falling oil prices will place a huge stress on the world's junk bond market as energy companies now account for 15 percent of the outstanding issuance in the non-investment grade bond market. The plunge in the prices of crude could trigger a "volatility shock large enough to trigger the next wave of defaults," according to Deutsche Bank.

This explains why the Obama administration - with complicity of both congressional Democrats and Republicans - managed in the wee hours of the morning to slip a loophole into the supposedly "must-pass" cliff-hanger omnibus budget bill. This toxic Trojan horse, passed in December 2014, now includes a minor footnote provision that might cause taxpayers to pick up the tab on more than a trillion dollars (yes, trillion) if the energy market bubble implodes, which it must if oil stays at half the price it fetched just six months ago.

After last minute, heavy lobbying on the budget bill by Jamie Dimon of JPMorgan Chase and an army of 3,000 Wall Street lobbyists, it appears that once again sufficient insecurity and fear had been spread among the political class regarding destabilization of the financial markets (or withdrawal of campaign financing). They allowed a last minute amendment that killed Dodd-Frank protections, and allowed US taxpayers to be shaken down to cover Wall Street's shale gambling debacle.

The heavy-handed move by the financial industry has outraged progressives and libertarians alike. It seems that these Wall Street criminals, like junkies attached to their drugs of choice, just could not resist the high of easy cash from Ponzi scheme market bubbles, and so they have stuck it to the US public once again: Preposterously huge bonuses, Porsches, pricey call girls, and million-dollar Manhattan condos were at stake. So hey, why should they kick the habit? After all, not a single one of those con artists went to jail last time.

Wall Street is now flooded with fracking industry derivatives contracts that protect the profits of oil producers from dramatic swings in the marketplace. Derivatives are essentially insurance policies taken out by the oil industry to guard against fluctuations in the cost of fossil fuel supplies. Dramatic swings rarely happen, but when they do they can be absolutely crippling.

Derivatives taken out to ensure prices don't go down are now creating billions in losses for those who sold such bets on the market; someone is going to have to absorb massive losses created by the sudden drop in oil on the other end of those insurance contracts. In many cases, it is the big Wall Street banks, and if the price of oil does not rebound substantially they could be facing colossal losses.

The big Wall Street banks did not expect plunging home prices to implode the mortgage-backed securities market in 2008, but their current models also did not have $60 oil prices included in projections. The huge losses may send a shock wave into the entire financial industry. It has been estimated that the six largest "too-big-to-fail" banks control $3.9 trillion in commodity derivatives contracts, those same gambling instruments that brought us the 2008 housing collapse. And a very large chunk of that amount is made up of oil derivatives. Combined with the huge flood of shale junk bonds on the market, the derivatives could initiate a bubble burst that could turn into a financial market implosion.

Meanwhile, the global climate change issue and energy market turbulence have morphed into geopolitical tensions over European fracking. Unsubstantiated allegations in a New York Times report by Andrew Higgins claim that the Russians are funding anti-fracking protests to maintain their hegemony over gas markets.

The allegations have infuriated environmentalists and climate justice activists. The last thing they want is to be made scapegoats for the fracking collapse and be played as the neo-Cold War dupes of the Russian empire. But memories of red-baiting suddenly hang in the air as (by seeming coincidence) dozens of right-wing media sites regularly devoted to anti-Soviet slanders or climate change denial immediatelypicked up Higgins' Times piece, as if on cue.

There are now dozens more of such published reports. Even as the US fracking industry collapses and tensions over control of Ukraine and other former Soviet satellites re-emerge, there seems to be a concerted right-wing effort to label fracking opponents Russian agents.

Vague innuendos dominate this narrative. In the Times piece, for example, former NATO Secretary General Anders Fogh Rasmussen is quoted: "I have met allies who can report that Russia, as part of their sophisticated information and disinformation operations, engage actively with so-called non-government organizations." Others write, "Some in Sophia believe" or "Those who suspect Russian involvement" or "There's no smoking gun, yet . . ."

Critics in Romania accused the Times and Higgins of scapegoating environmentalists and acting as partisan players in a renewed Cold War.

"What, exactly, is the grand total of evidence that Russia is financing these anti-fracking protests?" asks American blogger in Romania, Sam C. Roman, in his article, "Pot vs. Kettle," pointing out that the first anti-Russia allegation came from a politician who owned land that Chevron planned to frack, and is thus losing money from the protests. "Not one allegation against Russia in the entire article is proven by a single document, piece of evidence or other direct proof. All that exists are shadowy insinuations and allegations." He asserts that accusations by Lithuanian, Romanian and NATO officials against Russia have not yet to be backed up by any proof.

"Add it up," Roman writes. "You've got two former NATO [secretary generals] stumping for Chevron (which competes with Gazprom, a Russian energy company thatalso conducts fracking operations in Europe) blaming the Russian government for protests. . . . And all of this tied up in a neat little bow by an American journalist who has already been caught publishing anti-Russian propaganda in his newspaper before."

This all leaves the United States somewhat schizophrenic. On the one hand, the United States and NATO's foreign policy hawks are delighted by the oil price collapse; it serves to isolate and subdue Russia, expand NATO's influence in Eastern Europe, and puts pressure on Iran to negotiate on nuclear aspirations. Not to mention that with gasoline at $2 per gallon, consumer spending and economic growth will be enhanced. The US economy grew by a comparatively robust 5 percent in the third quarter of 2014.

According to an article by Larry Elliott in The Guardian, "Stakes Are High as US Plays the Oil Card Against Iran and Russia," the price drop was an act of geopolitical warfare by the United States, administered by the Saudis. Elliott suggests that US Secretary of State John Kerry allegedly struck a deal with Saudi Arabia's King Abdullah in September. That might explain how oil prices dropped during the crisis caused by Islamic State in Iraq and Syria, which would normally have caused prices to rise.

It would also explain why the Obama administration allowed the financial industry the amendment to Dodd-Frank that effectively exempts financial institutions from liability associated with derivatives. Though shale derivatives were not specifically mentioned by the Wall Street lobbyists as they pressured their allies in Congress and the White House, it is becoming increasingly clear that the too-big-to-fail banks were beginning to panic as dark clouds gathered on the horizon in the shale derivatives trade.

Most bank customers and voters don't know that Congress has already written into finance regulations that, in the case of insolvency, financial institutions could grab the assets of depositors and "bail-in" - which means they can save themselves from their losses in gambling operations at their investment divisions by grabbing cash assets of depositors, even those that are FDIC guaranteed, and legally convert them to bank stocks. That means that in the event of another market crash, Chase and Citi could take their depositors' cash in savings accounts or CDs, and give the customers back a bank stock certificate (of questionable value) instead.

There are also those who scratch their heads and ask, "Why did the TBTF banks push for a deletion of the Dodd-Frank provision now, instead of waiting for the friendlier Republican-controlled Congress to pass this legislation?" The only answer that seems to make sense, and explain their urgency, is that the collapse is imminent.

In the 1990s dot-com craze, every new Silicon Valley start-up company was advertised as the next Microsoft. What followed was the crash of 2000, when the NASDAQ dropped 4,000 points (80 percent) in months. This chart below is what the crash looked like in 2000 to 2002 after the market had reached 5,000 (almost exactly where it stands today).

Having learned their lesson well from the last bailout, and knowing that they will have a much harder time coming to Congress hat-in-hand after a collapse, the TBTF banks probably decided not to wait, pushing their minions in the Beltway to inoculate them as soon as possible from the potential market explosion.

Having learned their lesson well from the last bailout, and knowing that they will have a much harder time coming to Congress hat-in-hand after a collapse, the TBTF banks probably decided not to wait, pushing their minions in the Beltway to inoculate them as soon as possible from the potential market explosion.

In the meantime, they were probably dumping their own stocks on unsuspecting investors. Based on year-end reports for March 31, 2014, for 127 major oil companies, cash input for the fracking industry was $677 billion, while revenues from operations only totaled $568 billion - a difference of almost $110 billion. And this was before the price of oil started dropping six months ago.

In three out of seven major fracking fields in North America, companies are already reporting losses, with closures particularly acute in Canada. It's not clear whether economists fully appreciate what's about to transpire. This decline in rig count is just the beginning. Perhaps the end will come as early as this winter or spring, as fiscal reports for 2014's fourth quarter are published, operations shut down, crews are laid off, and many unprofitable oil and gas rigs are mothballed.

So, whom will the banks, brokers and investors scapegoat for this upcoming crash? Some predict that they will likely use every available media outlet to blame community activists, Democrats and Obama for stopping the Keystone pipeline and for opposing the fracking industry. And as in the climate change denier movement, the narrative will probably use "communist" and "socialist" rhetoric, which is why the Russian card is so important to play: Hence the Higgins article.

The pundits on Fox will likely play on the patriotism of the right and use their Big Lie ploy (say something enough times, it becomes the truth) to the hilt. Six months from now, while studiously avoiding mention of our "allies," the Saudis, or the Wall Street banks, they will likely be vociferously defending those poor "beleaguered US oilmen" who could have made our country strong and independent again in energy, but were broken by the Democrats and those "commie environmentalists" working for Putin. The market crash will be blamed on the "climate hoax."

Copyright, Truthout. Reprinted with permission

Link to original article from Truthout

Imagine going to the polls on Election Day and discovering that your ballot could be collected and reviewed by the

Imagine going to the polls on Election Day and discovering that your ballot could be collected and reviewed by the ACLU Blueprints Offer Vision to Cut US Incarceration Rate in Half by Prioritizing 'People Over Prisons'

ACLU Blueprints Offer Vision to Cut US Incarceration Rate in Half by Prioritizing 'People Over Prisons'  "These disasters drag into the light exactly who is already being thrown away," notes Naomi Klein

"These disasters drag into the light exactly who is already being thrown away," notes Naomi Klein  How about some good news? Kansas Democratic Representative advances bill for Native Peoples.

How about some good news? Kansas Democratic Representative advances bill for Native Peoples.  What mattered was that he showed up — that he put himself in front of the people whose opinions on

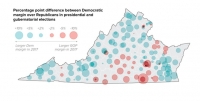

What mattered was that he showed up — that he put himself in front of the people whose opinions on On a night of Democratic victories, one of the most significant wins came in Virginia, where the party held onto

On a night of Democratic victories, one of the most significant wins came in Virginia, where the party held onto A seismic political battle that could send shockwaves all the way to the White House was launched last week in

A seismic political battle that could send shockwaves all the way to the White House was launched last week in In an interview with Reuters conducted a month after he took office, Donald Trump asserted that the U.S. had “fallen

In an interview with Reuters conducted a month after he took office, Donald Trump asserted that the U.S. had “fallen Attorney General Jeff Sessions overturned the sweeping criminal charging policy of former attorney general Eric H. Holder Jr. and directed

Attorney General Jeff Sessions overturned the sweeping criminal charging policy of former attorney general Eric H. Holder Jr. and directed